Guide to India’s Carbon Market: Deconstructing CCTS, CCCs, and Compliance

- C² Team

- Jan 5

- 3 min read

While many organizations have set Net-Zero targets, few understand the regulatory machinery being built to enforce them. The Indian Carbon Market (ICM) is no longer a concept it is a functional mechanism governed by the Bureau of Energy Efficiency (BEE).

For corporate India, navigating this requires understanding the transition from the old PAT (Perform, Achieve, and Trade) scheme to the new CCTS (Carbon Credit Trading Scheme). This post breaks down the technical framework, the trading units, and the compliance obligations for 2026.

1. The Core Mechanism: "Cap and Trade"

The CCTS operates on a "Cap and Trade" principle. Here is the operational breakdown:

The Cap: The government sets an emission intensity target (a specific limit on greenhouse gas emissions per unit of production) for specific sectors. This is the "Cap."

The Trade:

Over-Achievers: Companies that reduce emissions below their target earn Carbon Credit Certificates (CCCs).

Under-Achievers: Companies that exceed their emission limits must buy CCCs to compensate for the excess.

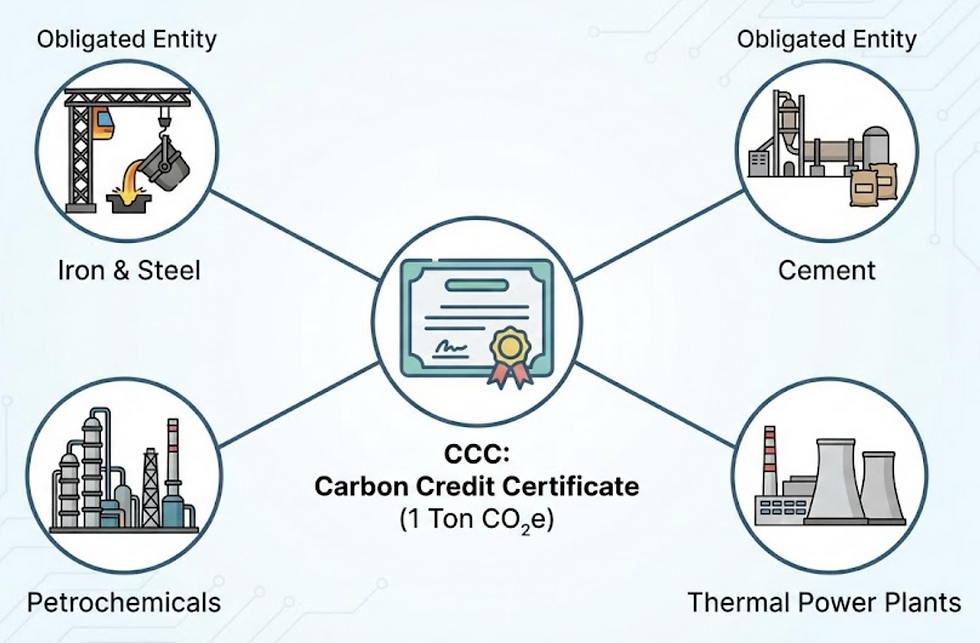

2. Who is Involved?

The Ministry has identified "Obligated Entities" (OEs) that constitute the compliance market. As of the 2025 notifications, these primarily include high-energy-intensity sectors:

Iron & Steel

Cement

Petrochemicals

Thermal Power Plant

If your organization falls into these categories, carbon trading is mandatory, not voluntary. Non-compliance attracts penalties under the Energy Conservation Act.

3. The Unit of Trade: What is a CCC?

A Carbon Credit Certificate (CCC) is the currency of this new market.

1 CCC = 1 Ton of CO₂ equivalent (tCO₂e) reduced or removed.

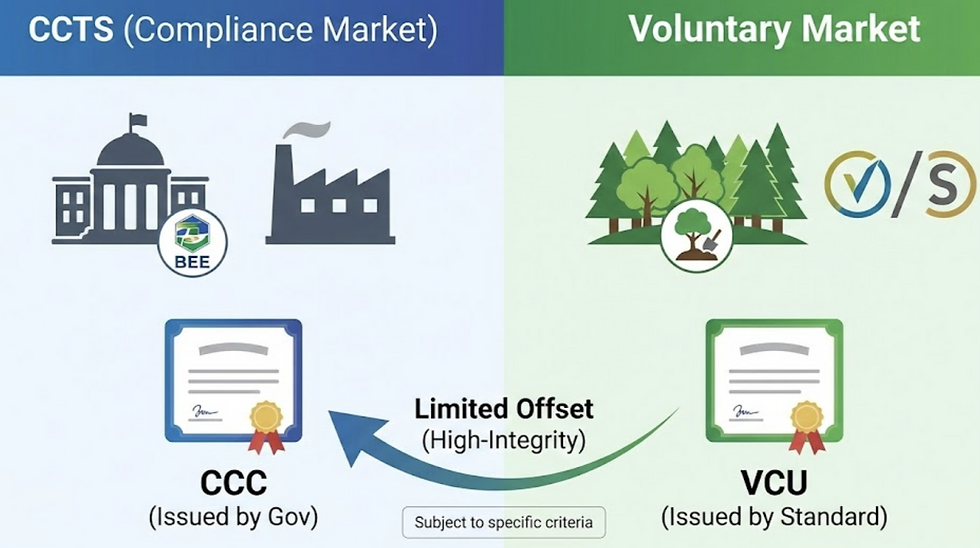

Crucial Distinction: CCTS vs. Voluntary Credits

This is where most confusion lies.

Compliance Credits (CCCs): Issued by the BEE to Obligated Entities. These are used strictly to meet government targets.

Voluntary Credits: Generated by independent projects (like our C² afforestation or biochar projects) and verified by standards like Verra or Gold Standard.

The 2026 Question: Can Voluntary credits be used for Compliance?

Currently, the "offset mechanism" allows for a limited percentage of voluntary credits to be used for compliance, provided they meet high-integrity criteria (e.g., permanent removal). This fungibility is what links the global VCM (Voluntary Carbon Market) to the Indian compliance market.

4. How Pricing Works

Unlike a "Carbon Tax" where the government fixes the price (e.g., $20/ton), the CCTS is market-driven.

Supply: Depends on how many companies over-achieve their targets.

Demand: Depends on industrial growth and strictness of the targets.

5. Verified Carbon Units (VCUs) vs. Green Credits (GCP)

It is important not to confuse CCTS with the Green Credit Program (GCP) launched by the MoEFCC.

CCTS focuses strictly on CO₂ Emission Reductions.

GCP incentivizes broader environmental actions like water conservation, soil health, and tree plantation on waste land.

While CCTS is about penalties and caps, GCP is about incentives and CSR. Smart organizations are now building portfolios that hold both: CCCs for compliance and Green Credits for brand reputation.

Summary: The Checklist for 2026

To ensure your organization is future-proof, ensure you have the following data points ready:

GHG Inventory: An ISO-14064 compliant audit of your Scope 1 and 2 emissions.

Gap Analysis: The difference between your current emissions and the government-mandated "Cap" for your sector.

Procurement Strategy: If you have a gap, we are here to provide high-integrity credits before the compliance deadline.

Need Technical Guidance?

Navigating the regulatory maze of BEE, CCTS, and GCP requires more than just good intentions it requires data. Contact Csquare for a technical consultation on your carbon liability.

Comments