𝐍𝐚𝐭𝐮𝐫𝐞 𝐢𝐬 𝐭𝐡𝐞 𝐧𝐞𝐰 𝐂𝐥𝐢𝐦𝐚𝐭𝐞. 𝐀𝐫𝐞 𝐲𝐨𝐮 𝐫𝐞𝐚𝐝𝐲 𝐟𝐨𝐫 TNFD?

- C² Team

- Dec 3, 2025

- 2 min read

We’ve all heard of carbon footprints and Net Zero. But what about our Nature Footprint?

Enter the 𝐓𝐍𝐅𝐃 Taskforce on Nature-related Financial Disclosures (TNFD)

Here is the simple breakdown of what it means, the "𝐋𝐄𝐀𝐏" approach everyone is talking about, and why Indian investors are watching closely.

1️⃣ 𝑾𝒉𝒂𝒕 𝒊𝒔 𝑻𝑵𝑭𝑫 𝒔𝒊𝒎𝒑𝒍𝒚? Think of it as a "Risk Assessment for Nature." Just like companies report financial profits and losses, TNFD asks them to report how they depend on nature (e.g., needing water for cooling towers) and how they impact nature.

To do this, companies follow the LEAP Approach:

• 𝐋𝐨𝐜𝐚𝐭𝐞: Where do we operate?

• 𝐄𝐯𝐚𝐥𝐮𝐚𝐭𝐞: What are our dependencies on nature there?

• 𝐀𝐬𝐬𝐞𝐬𝐬: What are the risks?

• 𝐏𝐫𝐞𝐩𝐚𝐫𝐞: What is our strategy to handle them?

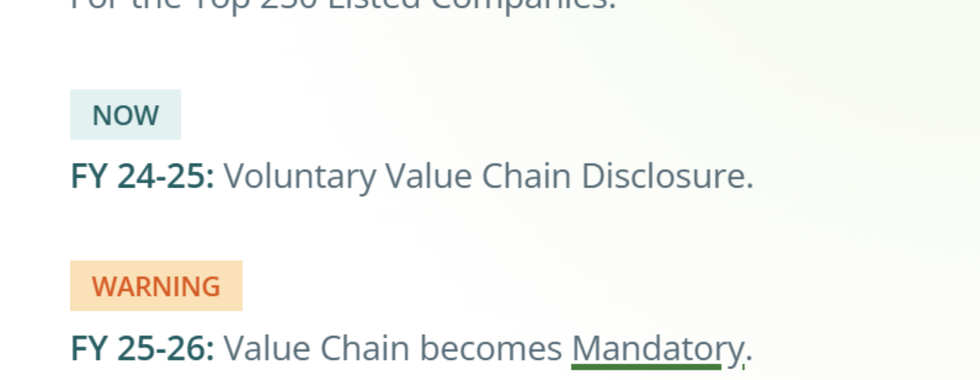

2️⃣ Is it mandatory in India? Not explicitly yet, but effectively YES for big players via SEBI's BRSR Core.

• 𝐆𝐥𝐨𝐛𝐚𝐥 𝐂𝐨𝐧𝐭𝐞𝐱𝐭: Companies worldwide are submitting their first reports right now (FY24/25).

• 𝐈𝐧𝐝𝐢𝐚 𝐓𝐢𝐦𝐞𝐥𝐢𝐧𝐞: While currently voluntary, strict "mandatory" assurance for the value chain is set to kick in for the top 250 listed companies in FY 2026-27.

• This gives companies about a year or two to get their data in order, but the clock is ticking.

3️⃣ 𝑾𝒉𝒐 𝒊𝒔 𝒂𝒍𝒓𝒆𝒂𝒅𝒚 𝒅𝒐𝒊𝒏𝒈 𝒊𝒕? Indian giants are not waiting for the mandate; they are adopting it to stay competitive.

• Tata Steel: Released their inaugural TNFD report for 2025.

• JSW Steel: Committed to the TNFD protocols using the LEAP framework.

• Adani Ports and SEZ & Ambuja Cements Limited: Committed to nature-related disclosures starting FY26.

• Tech Mahindra: Recently joined the TNFD Adopter Programme.

4️⃣ 𝑾𝒉𝒚 𝒊𝒔 𝒕𝒉𝒊𝒔 𝒊𝒎𝒑𝒂𝒄𝒕𝒇𝒖𝒍? It changes the definition of "liability." Previously, if a company used groundwater or degraded soil, it was often "free." TNFD forces companies to treat Nature as a balance sheet item.

𝑾𝒉𝒚 𝒅𝒐 𝒊𝒏𝒗𝒆𝒔𝒕𝒐𝒓𝒔 𝒍𝒐𝒗𝒆 𝒕𝒉𝒊𝒔? It tells them if a company is "future-proof." If a business relies on a forest that is fast disappearing, that company is a bad investment. TNFD highlights that hidden risk before it becomes a financial loss.

𝑻𝒉𝒆 𝑩𝒐𝒕𝒕𝒐𝒎 𝑳𝒊𝒏𝒆: Nature loss is no longer just an environmental issue; it’s a financial risk. Companies that start "LEAP-ing" now will lead the market. Those who ignore it risk being left behind.

𝑹𝒆𝒂𝒅𝒚 𝒕𝒐 𝒎𝒂𝒌𝒆 𝒚𝒐𝒖𝒓 𝒃𝒖𝒔𝒊𝒏𝒆𝒔𝒔 𝒏𝒂𝒕𝒖𝒓𝒆-𝒑𝒐𝒔𝒊𝒕𝒊𝒗𝒆 𝒂𝒏𝒅 𝒇𝒖𝒕𝒖𝒓𝒆-𝒓𝒆𝒂𝒅𝒚?

👉 𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐰𝐢𝐭𝐡 C² (Csquare) 𝐭𝐨 𝐠𝐞𝐭 𝐬𝐭𝐚𝐫𝐭𝐞𝐝!

🌐 𝐜𝐬𝐪𝐮𝐚𝐫𝐞𝐜𝐚𝐫𝐛𝐨𝐧.𝐜𝐨𝐦

✉️ 𝐢𝐧𝐟𝐨@𝐜𝐬𝐪𝐮𝐚𝐫𝐞.𝐜𝐨.𝐢𝐧

Comments